Table of Contents

Financial Policy Statement

A guide to personal finance.

Investing

The fundamental method to achieve success in investing is by creating a written investment policy statement and following it exactly as written. You should never make modifications to this statement based on current events or beliefs about future events. This will almost assuredly hinder you from reaching your long term goals. However, modification based on personal life changes may be acceptable.

When creating the investment policy statement, keep the following principles in mind:

- Understand the difference between a product that is sold and one that is bought. Most financial advisers are neither regulated nor fiduciary, rather they are salesmen who make commission from selling terrible investment products to fleece oblivious customers. Hence, most financial products only exist because there is someone who can sell them, not because there is demand for them. Research available funds/products and only purchase those which the financial community unanimously agrees is a low cost, superior investment.

- More money is lost by trading and timing the market than by following a pre-specified investment plan.

- A successful stop loss requires you to be correct twice, once when selling and again when re-entering a position. Outside of random luck, you won’t profit from this strategy.

- On average, lump-sum investing provides higher returns compared to dollar cost averaging.

- It’s inevitable the market index will have high variability and will drop more than 50%. Despite this, you will realize long term gains by maintaining and rebalancing your investments.

- You may only sell investments after they are sufficient to support you in retirement, you create a tax-advantaged withdrawal plan, and you have decided to retire.

Investment Allocation

The most important investment consideration is the asset allocation which will allow you to sleep at night. For example:

- 10% Cash

- An investment class which will always return your dollar, but not much more. Usually loses to inflation.

- 15% Bonds/TIPS

- An investment class which is expected to return more than cash, but is generally more stable than stocks.

- 50% Total US Stock

- An investment class which provides reasonably high reward for reasonably high risk.

- 25% Total International Stock

- An investment class which provides reasonably high reward for reasonably high risk.

Open an investment account at a reputable low-fee broker, choose a single low-cost index fund (either ETF or mutual fund investment types) for each of those four categories, then purchase the four chosen investments at the allocation percentage you have chosen.

Not sure where to start with selecting an asset allocation? Consider Larry Swedroe’s take:

- How much risk do you have the ability to take

- How much risk do you have the willingness to take

- How much risk do you need to take

- How to deal with conflicts between the need, ability and willingness to take risk

What does market risk look like?

- The US total market index dropped 56% from October 2007 to March 2009. It didn’t recover to the previous high until January 2013. Ignoring dividends, your investment return would have been zero for 6 years.

- The Nasdaq 100 index dropped 77% from March 2000 to September 2002. It didn’t return to the previous high until August 2016. Ignoring dividends, your return would have been zero for 16 years.

- The Nikkei 225 index dropped 62% from December 1989 to August 1992. It further dropped to the lowest level (81%) on March 2009. In June 2023 (31 years later) the index was 13% below the previous high mark. Ignoring dividends, it has not yet recovered to the previous high.

You want to avoid lump summing an entire life savings into a once in a lifetime market run-up (Japan). You want to avoid the increased risk of factor specific exposure (Nasdaq). You want a simple, diversified portfolio that can be rebalanced during inevitable drawdowns. It’s important to note that variance itself is not risk, rather it’s associated with underlying risk. In fact, rebalancing in a high variance scenario can lead to better outcomes than a low variance scenario.

Investments

Consider these low cost, high quality investments. Be extremely wary of any fund that is not on this list.

| Class | Type | Category | Vanguard | Fidelity | Schwab | TreasuryDirect |

|---|---|---|---|---|---|---|

| Stock | ETF | US Index | VTI | ITOT | SCHB | |

| Stock | ETF | US 500 | VOO | IVV | SCHX | |

| Stock | ETF | International Index | VXUS | IXUS | SCHF | |

| Stock | Mutual Fund | US Index | VTSAX | FSKAX | SWTSX | |

| Stock | Mutual Fund | US 500 | VFIAX | FXAIX | SWPPX | |

| Stock | Mutual Fund | International Index | VTIAX | FTIHX | SWISX | |

| Bond | ETF | US Index | BND | AGG | SCHZ | |

| Bond | ETF | Municipal | VTEB | MUB | SWNTX | |

| Bond | ETF | Inflation Protected | VTIP | TIP | SWRSX | |

| Bond | Mutual Fund | US Index | VBTLX | FXNAX | SWAGX | |

| Bond | Mutual Fund | Municipal | VWITX | FMBIX | SWNTX | |

| Bond | Mutual Fund | Inflation Protected | VIPSX | FIPDX | SWRSX | |

| Bond | Other | Inflation Protected | I Bond | |||

| Cash | Mutual Fund | Money Market | VMFXX | SPAXX | SWVXX | |

| Cash | Mutual Fund | Money Market | VUSXX | SPRXX | SNOXX |

Account Types

A brief summary of account types:

Category | Personal Brokerage Account | IRA | Roth IRA | 401k, 403b, 457b, and 401a | Roth (401k, 403b, 457b, and 401a) | Solo 401k | Roth Solo 401k | HSA |

|---|---|---|---|---|---|---|---|---|

Who manages this account | You | You | You | Employer | Employer | You | You | You or employer |

Contribution source | Any Money | Earned Income | Earned Income | Payroll Deduction | Payroll Deduction | Earned Income | Earned Income | Any Money or Payroll Deduction |

Contribution taxability | After Tax | Before Tax | After Tax | Before Tax | After Tax | Before Tax | After Tax | Before Tax |

Limitations on contributions | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Tax burden of selling in account | Short/long term capital gains | Tax Free | Tax Free | Tax Free | Tax Free | Tax Free | Tax Free | Tax Free |

Tax burden of withdrawals | N/A | Income Tax | Tax Free | Income Tax | Tax Free | Income Tax | Tax Free | Tax Free |

Limitations on withdrawals | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

And in slightly more detail:

- Non tax-advantaged

- Personal brokerage account (AKA Taxable account)

- You open this account yourself at a reputable brokerage.

- You contribute to the account using money that has already been taxed (gifted or earned income).

- The growth (profit) is taxed at short-term capital gains or long-term capital gains rates any time you sell.

- Personal brokerage account (AKA Taxable account)

- Tax-advantaged

- Personal

- IRA

- You open this account yourself at a reputable brokerage.

- You contribute to the account using earned income, and these contributions will be deducted from your federal income tax liability.

- The growth (profit) is tax free when held inside the account.

- You will be taxed ordinary income tax rates on the amount withdrawn from the account.

- Contributions are limited to $6,000/year (2022).

- You can’t withdraw money (penalty) before 59.5 years old.

- You must begin withdrawing a specified portion of the funds in your account at age 72 (year 2022).

- Roth IRA

- You open this account yourself at a reputable brokerage.

- You contribute to the account using earned income, and these contributions will not be deducted from your federal income tax liability.

- You won’t pay taxes on anything inside or withdrawn from the account.

- Contributions are limited to $6,000/year (2022).

- You can’t withdraw money (penalty) before 59.5 years old.

- No required minimum distribution while owner is alive.

- IRA

- Employer

- 401k, 403b, 457b, and 401a

- Non-Roth

- Your employer implements and is responsible for this account.

- You contribute to the account using payroll deductions, and these deductions reduce your federal income tax liability.

- The growth (profit) is tax free when held inside the account.

- You will be taxed ordinary income tax rates on the amount withdrawn from the account.

- You can contribute up to $20,500/year (year 2022).

- Your employer may contribute additional money beyond the $20,500/year (year 2022) limit.

- You can’t withdraw money without penalty (excluding 457b) before 59.5 years old.

- You must begin withdrawing a specified portion of the funds in your account at age 72 (year 2022).

- Roth

- Your employer implements and is responsible for this account.

- You contribute to the account using payroll deductions, and these deductions won’t reduce your federal income tax liability.

- You won’t pay taxes on anything inside or withdrawn from the account.

- You can contribute up to $20,500/year (year 2022).

- Your employer may contribute additional money beyond the $20,500/year (year 2022) limit; however, this money is pre-tax (non-Roth).

- You can’t withdraw money without penalty (excluding 457b) before 59.5 years old.

- You must begin withdrawing a specified portion of the funds in your account at age 72 (year 2022).

- Non-Roth

- 401k, 403b, 457b, and 401a

- Self-employed

- One-participant 401k (Solo 401k)

- Non-Roth

- You open this account yourself at any reputable brokerage, as long as you are a single member sole proprietor/LLC.

- You contribute to the account using payroll deductions, and these deductions reduce your federal income tax liability.

- The growth (profit) is tax free when held inside the account.

- You will be taxed ordinary income tax rates on the amount withdrawn from the account.

- The employee (i.e. you) can contribute 100% of earned income, up to $20,500. This $20,500 limit (year 2022) is shared with W-2 income retirement accounts 401k and 403b.

- The employer (i.e. you) can contribute up to 25% of earned income, without going over the $61,000 limit (employer + employee contributions) (year 2022).

- You can’t withdraw money without penalty before 59.5 years old.

- You must begin withdrawing a specified portion of the funds in your account at age 72 (year 2022).

- You will need to file form 5500-EZ if you have $250,000 or more in the account or close the account.

- Roth

- You open this account yourself at any reputable brokerage, as long as you are a single member sole proprietor/LLC.

- You contribute to the account using payroll deductions, and these deductions won’t reduce your federal income tax liability.

- You won’t pay taxes on anything inside or withdrawn from the account.

- The employee (i.e. you) can contribute 100% of earned income, up to $20,500. This $20,500 limit (year 2022) is shared with W-2 income retirement accounts 401k and 403b.

- The employer (i.e. you) can contribute up to 25% of earned income, without going over the $61,000 limit (employer + employee contributions) (year 2022); however, this money is pre-tax (non-Roth).

- You can’t withdraw money (penalty) before 59.5 years old.

- You must begin withdrawing a specified portion of the funds in your account at age 72 (year 2022). This rule can be mitigated by executing a trustee-to-trustee rollover to a Roth IRA upon retirement.

- You will need to file form 5500-EZ if you have $250,000 or more in the account or close the account.

- Non-Roth

- One-participant 401k (Solo 401k)

- Medical

- Health Savings Account (HSA)

- There is no Roth vs Non-Roth distinction.

- Only available if you have an HSA-qualified health plan, also known as a high-deductible health plan (HDHP)

- You open this account yourself at any reputable brokerage, or your employer implements and is responsible for this account.

- You contribute to the account using your own (gifted or taxed) money, or through employer payroll deductions. These contributions will reduce your federal income tax liability.

- The growth (profit) is tax free when held inside the account.

- You will not pay taxes on any money withdrawn from the account that is used to pay for qualified medical bills.

- You may contribute $3,650/year for an individual plan and $7,300/year for a family plan (year 2022).

- On death, a surviving spouse may inherit the HSA tax free. Non-spouse inheritance is immediately taxable at income tax rates.

- Health Savings Account (HSA)

- Personal

Contribution Hierarchy

When you have spare cash what account should it be directed to first?

- (Roth) 401k

- (Roth) 457b

- (Roth) 403b

- Roth IRA

- HSA

- Taxable

As long as you are not at the top of the tax bracket now, and expect to be at the bottom of the tax bracket in retirement, any Roth option should be used as the default choice. Taxes are low right now, so there is little reason to defer to a potentially higher cost.

You can access your employers Form 5500 filing (annual return/report of employee benefit plan) at https://www.efast.dol.gov/portal/app/disseminatePublic.

What to do when you have a large tax deferred IRA and it’s preventing you from contributing to a Roth IRA? Roll it over to a one-participant 401k (solo 401k).

- Get an EIN at https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

- Earn money through self-employment, report it on schedule C and schedule SE.

- Open a one-participant 401k.

- The employee (i.e. you) can contribute 100% of earned income, up to $20,500. This $20,500 limit is shared with w-2 income retirement accounts 401k and 403b.

- Earned income is defined as net earnings = total income - business expenses - 1/2 of self-employment tax .

- The employer (i.e. you) can contribute up to 25% of earned income, without going over the $61,000 limit (employer + employee contributions).

- Online calculators are available here:

- The employee (i.e. you) can contribute 100% of earned income, up to $20,500. This $20,500 limit is shared with w-2 income retirement accounts 401k and 403b.

- Roll the IRA over to the one-participant 401k.

- Now contribute to the Roth IRA.

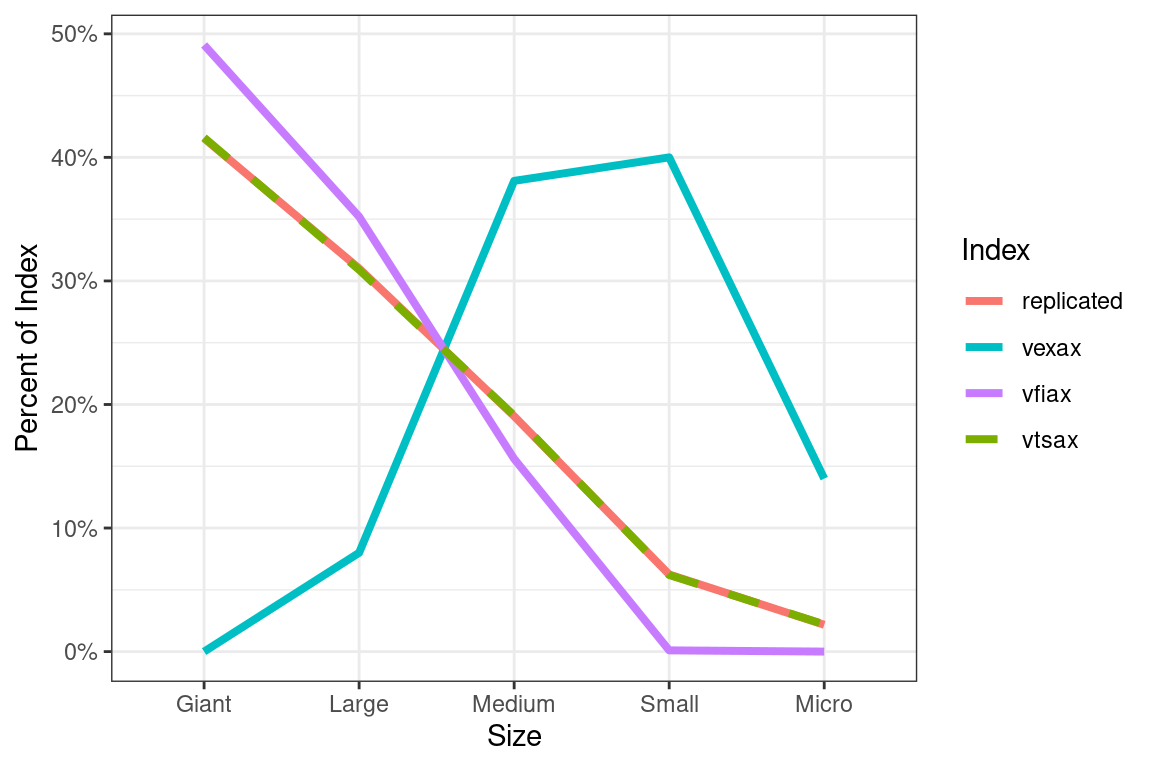

Replicating an index

Does your employer provide you with a mix of terrible or factor specific funds? While you’re waiting to recoup those losses after the class-action lawsuit, here is how you could replicate an index from a separate set of funds.

Schwab provides market cap distributions for funds.

Let’s use OLS!

vtsax <- c(Giant = 41.6, Large = 30.9, Medium = 19.1, Small = 6.2, Micro = 2.2)

vfiax <- c(Giant = 49.1, Large = 35.2, Medium = 15.6, Small = 0.1, Micro = 0)

vexax <- c(Giant = 0, Large = 8, Medium = 38.1, Small = 40, Micro = 14)

mod <- lm(vtsax ~ vfiax + vexax)

summary(mod)##

## Call:

## lm(formula = vtsax ~ vfiax + vexax)

##

## Residuals:

## Giant Large Medium Small Micro

## 0.06333 -0.10981 0.04869 -0.03637 0.03416

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.019539 0.144382 0.135 0.904742

## vfiax 0.845563 0.003354 252.135 0.0000157

## vexax 0.153307 0.004035 37.992 0.000692

##

## Residual standard error: 0.1023 on 2 degrees of freedom

## Multiple R-squared: 1, Adjusted R-squared: 1

## F-statistic: 5.225e+04 on 2 and 2 DF, p-value: 0.00001914# Or, more simply

X <- cbind(vfiax, vexax)

Y <- vtsax

round(solve(t(X) %*% X) %*% t(X) %*% Y, digits = 2)## [,1]

## vfiax 0.85

## vexax 0.15df <- data.frame(

Size = factor(names(vtsax), levels = c("Giant", "Large", "Medium", "Small", "Micro")),

vtsax,

vfiax,

vexax,

replicated = round(predict(mod), 2)

)

df[c("vtsax", "replicated")]## vtsax replicated

## Giant 41.6 41.54

## Large 30.9 31.01

## Medium 19.1 19.05

## Small 6.2 6.24

## Micro 2.2 2.17df <- gather(df, key = "Index", value = "Percent", vtsax, vfiax, vexax, replicated)

ggplot(df, aes(x = Size, y = Percent / 100, color = Index, group = Index)) +

geom_line(aes(linetype = Index), linewidth = 1.4) +

scale_y_continuous(labels = scales::percent) +

scale_linetype_manual(values=c("solid", "solid", "solid", "dashed")) +

scale_color_manual(values = c("#f8766d", "#00bfc4", "#c77cff", "#7cae00")) +

labs(y = "Percent of Index")

Investment Considerations

- Expense ratios should be below 0.25%. Be suspicious and avoid funds that are above this expense ratio.

- Utilize new contributions to rebalance the allocations.

- Rebalance quarterly/yearly/as necessary by adjusting the tax-deferred holdings or taxable holdings (if losses or long-term gains are available). A common rebalancing point is when allocations break the 5% absolute or 25% relative boundaries. The purpose of rebalancing is to buy one sector of investments that are down with a separate sector of investments that are up. This allows you to ‘buy low and sell high’ and controls the risk level you set in the investment allocation.

- Utilize cash and bonds as necessary to purchase on short term panic drops 10%+ or longer bear markets.

Tax Considerations

- Hold tax free bonds in taxable accounts. Or, even better, keep bonds only in retirement savings accounts.

- Tax efficient index funds (no capital gains) in taxable accounts makes life easier during tax time.

- A small number of invested index funds makes life easier during tax time (and general record keeping).

- Convert traditional holdings to Roth when marginal tax rate is low (<22%).

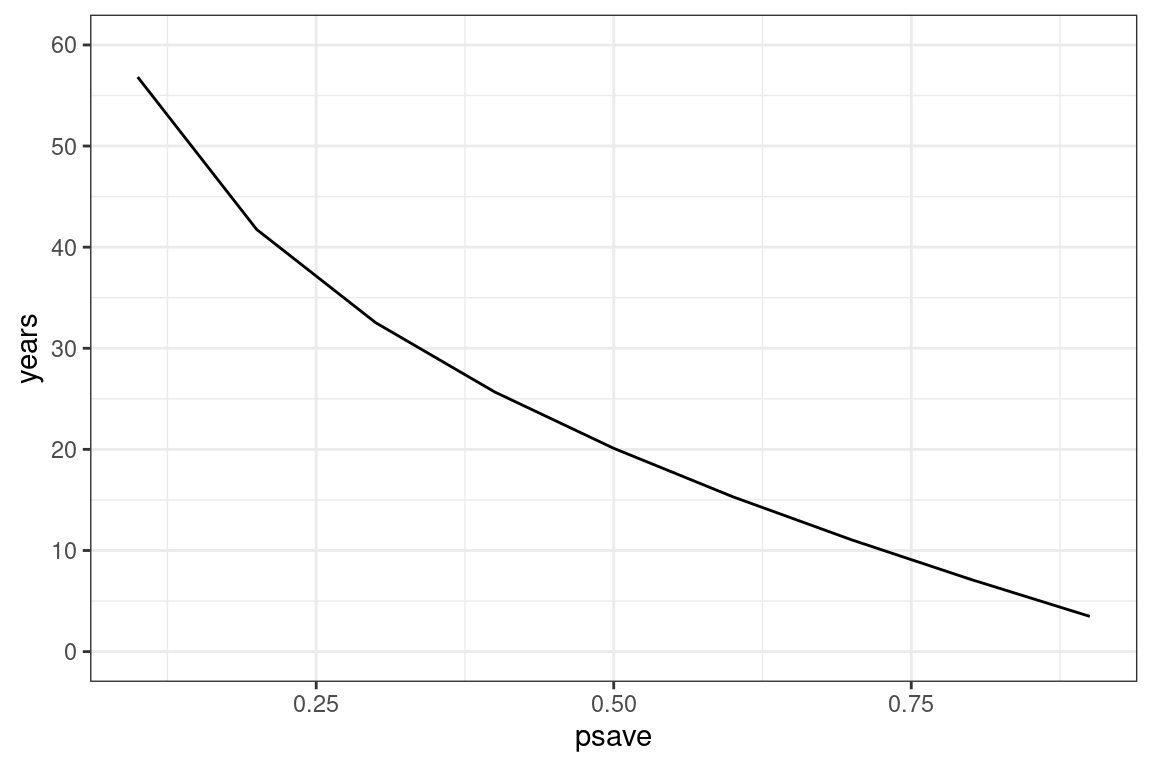

Financial independence

When investments are equal to at least 33x expected annual spending in retirement (i.e. 3%), employment is no longer necessary :)

- Track expenses and calculate expected annual spending as the average of the previous decade.

- Multiply your expected annual spending by a safety factor (1.25x, 1.5x) to cover unexpected events in government policy, the financial system, and your spending. You need to be prepared for a scenario where the market halves and stays flat for 30 years.

- Does this seem unreasonable? Fix that by spending less.

# psave = proportion of salary saved and invested

# swr = safe withdrawal rate

# return = expected investment return

# years = years until financial independence

years <- function(psave, swr, return) {

expense <- 1 - psave

log(((expense * (1 / swr) * return) / psave) + 1) / log(1 + return)

}

df <- data.frame(psave = seq(from = .1, to = .9, by = .1))

df$years <- years(psave = df$psave, swr = 0.03, return = 0.05)

df## psave years

## 1 0.1 56.826796

## 2 0.2 41.747798

## 3 0.3 32.526332

## 4 0.4 25.676548

## 5 0.5 20.103012

## 6 0.6 15.314857

## 7 0.7 11.047237

## 8 0.8 7.138871

## 9 0.9 3.482239ggplot(df, aes(x = psave, y = years)) +

geom_line() +

scale_y_continuous(breaks = seq(0, 60, 10), limits = c(0, 60))

Insurance

Protect your assets with insurance.

- Term life insurance

- Hold term life insurance when you have dependents and are not financially independent.

- Many jobs provide term life insurance. Keep a personal policy as you don’t want this tied to the job.

- If traveling, and while during transport, credit cards often offer automatic term life insurance if used to purchase travel method (airlines).

- If you are young and the insurance amount is less than one million, most insurance providers do not require physical health checks before approval.

- It’s usually a pretty easy process to acquire by going through a local insurance agent who can get quotes from several companies (verify these with instant internet quotes).

- Renters or Home insurance

- Be sure your homeowners policy includes extended dwelling coverage as it will replace or rebuild your property even if the cost exceeds your policy’s coverage

- Car insurance

- Liability coverage: If you’re responsible for an accident, your liability coverage will cover the costs of any injuries or property damage caused in the collision. If the other person is responsible, and they have liability coverage, then they will pay for your damage. Most states require you to carry a minimum amount of coverage.

- Minimum property damage liability you should have is $100,000 (i.e. plan max).

- Minimum bodily injury liability you should have is $250,000 (i.e. plan max).

- Liability coverage is the most important part of car insurance and you can only further reduce exposure to this liability through umbrella insurance!

- Collision coverage: No matter who is at fault, collision coverage pays to repair or replace your car if you’re in an accident with another vehicle, object, or even yourself. Can be useful for filing a claim with your personal insurance company so that they are the ones who get you money from other insurance company when someone else is at fault. Collision coverage is needed to insure rental vehicles. Is quite expensive. Only needed if your car is worth more than 3x your deductible?

- Comprehensive coverage: This level of insurance covers your losses that aren’t caused by a car crash such as theft, vandalism, flood, fire and hail. Probably the most common use for this is to replace window glass? Usually pretty cheap. Only needed if your car is worth more than 2x your deductible?

- Uninsured and Underinsured coverage: It will pay you if the other person is at fault, but they do not carry insurance or are underinsured and broke (i.e. the majority of people who drive cars).

- If you carry collision, then separate un/underinsured property damage coverage isn’t needed. If you don’t carry collision, then property damage coverage is pretty cheap for what is usually a very small maximum coverage ($7,500).

- Minimum bodily injury liability you should have is $250,000 (i.e. plan max).

- If renting, credit cards often offer automatic rental insurance if used for purchase. Though, recently, many have been canceling these additional benefits. Otherwise collision coverage will be needed to cover rentals.

- Liability coverage: If you’re responsible for an accident, your liability coverage will cover the costs of any injuries or property damage caused in the collision. If the other person is responsible, and they have liability coverage, then they will pay for your damage. Most states require you to carry a minimum amount of coverage.

- Health insurance

- Unfortunately health insurance has little to do with covering unexpected costs. It’s more of a middle-man payment system that, in combination with healthcare providers, means the market for healthcare is not a service/good to be purchased, but rather a rent to be extracted.

- If not supplied by your employer, use the ACA marketplace at healthcare.gov to search for policies.

- Alternative healthcare sharing accounts through faith based companies are also available. These contracts are often not as robust as traditional insurance and can have maximum payouts ($150,000) or drop clauses for who knows what (smoking, no support from pastor, etc.). They generally operate by expecting you to pay cash for all bills. After submitting these receipts, they will provide partial refunds.

- Long-term care insurance

- Purchase in 50s

- Reassess as needed as it is currently very expensive or no longer reasonable with current healthcare inflation?

- Umbrella insurance

- This insurance gives protection for you and your assets when you need liability coverage that exceeds the limits of your homeowners or auto insurance. You want an additional buffer between traditional insurance liability limits (~250-500K) and your at-risk assets (anything held outside of ERISA-qualified plans, e.g. 401k or other non-governmental retirement savings accounts) when they become large enough to be enticing. About 80% of umbrella claims are a result of car crashes. This coverage usually doesn’t cover personal business issues (malpractice, etc.), extreme sports and racing, pollution/chemical/radiation incidents, any intentional damage caused by covered entity, transmission of disease, damage resulting from serving alcohol, damage caused by mold/mildew, etc.

- FDIC (bank) insurance

- The FDIC insures up to $250,000 per bank account. If you have more than $250,000 in a bank account, there are two methods for extra protection. First, you can open multiple accounts across different banks, or within the same bank (one spouse and one joint (2x250,000) for 1,000,000 total). Second, the FDIC will protect $250,000 per beneficiary noted as payable on death (POD; and informal revocable trust), up to five beneficeries for a total of $1,250,000 protected assets per account (https://www.fdic.gov/resources/deposit-insurance/financial-products-insured/). Financial products not insured by the FDIC: https://www.fdic.gov/resources/deposit-insurance/financial-products-not-insured/

- SIPC (brokerage) insurance

- The SIPC is a non-profit corporation established by the securities investor protection act. It oversees the liquidation of covered brokerages that close when they go bankrupt or are in financial trouble, and customer assets are missing. The SIPC will return missing customer property by protecting each customer up to $500,000 for securities and cash (including a $250,000 limit for cash only).

- Although created under a federal law, SIPC is not an agency or establishment of the United States Government, and it has no authority to investigate or regulate its member broker-dealers. It is important to understand that SIPC is not the securities world equivalent of the Federal Deposit Insurance Corporation (FDIC), which insures depositors of insured banks.

- Any respectable brokerage will also have ‘Excess of SIPC’ insurance in addition to SIPC. However, in a truly catastrophic event, the total excess insurance is usually pitifully small compared to total assets under management.

- Service/contractor insurance

- Before entering a business agreement, require a Certificate of Liability Insurance. It will verify the policy holder, insurance company, policy number, limits of coverage, and type of liability. Ask/require that you are added as an “additional insured” to this policy. This all must be done prior to start of work. Make sure to stipulate in the contract requirements that notice must be given before any cancellation or change in insurance status, a waiver of subrogation applies to you?, and coverage provided is primary and non-contributory. Other forms of interest are the rider and floater.

Family Planning

- Create a will once you have dependents. Update the will and beneficiaries of all accounts with each new dependent.

- Living Will

- Advance Healthcare Directive

- Durable and Standby Power of Attorney

- Health Care Surrogate Designation

- Last Will and Testament

- Testamentary Trust

- Living Will

Other Financial Items

- Annual credit report

- Credit card advertising opt-out

- Credit reporting agency opt-out

- Equifax “the work number” opt-out

- Go to https://theworknumber.com/view-my-data-sign-up

- Create an account and make note of your account ID (that you choose yourself). You will be asked for it.

- Download your report to see what information they have collected on you.

- Go to https://theworknumber.com/employee-data-freeze/

- Call their number 866-222-5880.

- Choose the option option to report a possible identity theft.

- Tell them “I’d like to put a freeze on my employment data”.

- When asked why, just say “For personal reasons”.

- They will ask for your account ID, SSN, and other information to verify your identity.

- They will send you a text code to verify and the process should be over.

References

- https://www.bogleheads.org/wiki/Main_Page

- https://www.bogleheads.org/wiki/Tools_and_calculators

- https://www.bogleheads.org/forum/viewtopic.php?t=7353&highlight=collective

- https://www.madfientist.com/how-to-access-retirement-funds-early/

- https://earlyretirementnow.com/2016/12/14/the-ultimate-guide-to-safe-withdrawal-rates-part-2-capital-preservation-vs-capital-depletion/

- https://www.portfoliovisualizer.com/

Last Updated: 2023-10-31